Introduction: The Foundations of Prosperity and Influence

Resources—whether financial, material, or human—provide the fuel for ambition and the leverage for influence. Without sufficient resources, even the most brilliant strategies remain theoretical. This module explores how to systematically accumulate and manage resources through six interconnected approaches that form a comprehensive resource mastery system.

Drawing from Chanakya's Arthashastra, which devoted significant attention to resource management and wealth creation, the resource acquisition strategies of European empires, and the prosperity principles embedded in Indian cultural traditions, we will develop a balanced approach to resource accumulation that supports long-term influence and impact.

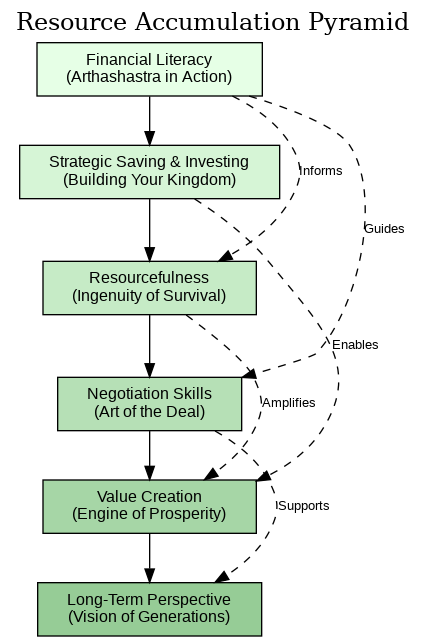

The Resource Accumulation Pyramid illustrates how the six elements of resource mastery build upon each other to create lasting prosperity.

1. Financial Literacy (Arthashastra in Action)

Historical Context

Chanakya's Arthashastra devoted significant attention to economic principles, taxation, and treasury management, recognizing that financial understanding was fundamental to state power. The text's very name acknowledges the centrality of "artha" (wealth/prosperity) to effective governance. European empires similarly developed sophisticated financial systems that enabled their expansion and influence.

Contemporary Relevance

Financial literacy remains a fundamental skill for personal and organizational leadership. Research shows that financial knowledge directly correlates with wealth accumulation, independent of income level. Understanding financial principles allows leaders to make informed decisions, allocate resources effectively, and create sustainable foundations for their initiatives.

Key Principles

- Income Awareness: Understand all sources and patterns of incoming resources

- Expense Management: Categorize and optimize outgoing resource flows

- Financial Statement Literacy: Comprehend balance sheets, income statements, and cash flow

- Risk Assessment: Evaluate financial risks and appropriate mitigation strategies

- Financial Planning: Develop structured approaches to resource allocation over time

Practical Application

To develop financial literacy:

- Create a personal financial statement (assets, liabilities, income, expenses)

- Track all income and expenses for at least 30 days to establish awareness

- Calculate key financial ratios (savings rate, debt-to-income, etc.)

- Study fundamental financial concepts through books and courses

- Practice financial analysis with case studies or your own financial data

- Develop a basic financial plan with specific targets and timelines

Use the Financial Intelligence Assessment in the Implementation Resources section to establish your baseline and identify priority areas for development.

For 17-25 Year Olds

Focus on establishing strong financial habits early: tracking expenses, avoiding high-interest debt, and beginning to save and invest. Develop financial literacy through books, courses, and mentorship. Use this period to experiment with low-risk financial strategies while stakes are relatively low.

For 30-45 Year Olds

Conduct a comprehensive financial audit to identify inefficiencies and opportunities. Optimize tax strategies, investment approaches, and debt structures. Develop more sophisticated financial planning that incorporates multiple income streams and longer time horizons.

2. Strategic Saving and Investing (Building Your Kingdom)

Historical Context

Chanakya emphasized the importance of systematically building treasury reserves for both security and opportunity. The text outlines specific proportions for saving and various categories of expenditure. European empires developed sophisticated investment strategies, often reinvesting colonial profits into further expansion and development.

Contemporary Relevance

Research consistently shows that systematic saving and investing is the primary determinant of wealth accumulation over time. The power of compound growth transforms modest regular investments into significant resources. Strategic resource allocation between different asset classes creates both security and growth potential.

Key Principles

- Systematic Approach: Establish regular, automated saving and investing processes

- Pay-Yourself-First: Allocate resources to savings before discretionary expenses

- Diversification: Distribute investments across different asset classes and vehicles

- Risk Management: Balance growth potential with appropriate security measures

- Compound Growth: Leverage time and reinvestment for exponential results

Practical Application

To implement strategic saving and investing:

- Establish an emergency fund covering 3-6 months of essential expenses

- Automate savings with direct deposits to investment accounts

- Develop an investment policy statement with allocation targets

- Create a regular review process for investment performance

- Gradually increase your savings rate as income grows

- Educate yourself about different investment vehicles and strategies

For 17-25 Year Olds

Focus on establishing the saving and investing habit, even with small amounts. Take advantage of your long time horizon by allocating more to growth investments. Learn fundamental investment principles through practice with modest sums before scaling up.

For 30-45 Year Olds

Optimize your investment strategy based on accumulated experience and resources. Consider more sophisticated approaches like real estate, business investments, or alternative assets. Balance growth objectives with increasing attention to risk management as your resource base grows.

3. Resourcefulness (Ingenuity of Survival)

Historical Context

Indian cultural traditions emphasize "jugaad"—creative problem-solving with limited resources. Chanakya advised leaders to maximize the utility of available resources rather than lamenting limitations. European colonial expansion often required resourceful adaptation to unfamiliar environments with limited supply lines.

Contemporary Relevance

In rapidly changing environments, the ability to creatively leverage available resources often provides competitive advantage. Research on entrepreneurial success highlights resourcefulness as a key differentiator, allowing leaders to accomplish more with less and adapt quickly to constraints.

Key Principles

- Creative Repurposing: Find new applications for existing resources

- Constraint Leveraging: Use limitations as catalysts for innovation

- Resource Maximization: Extract full value from all available assets

- Waste Elimination: Identify and minimize resource inefficiencies

- Collaborative Sharing: Pool resources with others for mutual benefit

Practical Application

To develop resourcefulness:

- Conduct a comprehensive inventory of all available resources

- Practice solving problems with artificial constraints

- Identify underutilized assets that could be leveraged differently

- Study examples of resourceful solutions in your field

- Develop systems for sharing resources with strategic partners

- Regularly audit processes for waste and inefficiency

For 17-25 Year Olds

Embrace the constraints of your current resource limitations as creativity catalysts. Develop the habit of accomplishing goals with minimal resources. Build skills in identifying and accessing shared or underutilized resources in your environment.

For 30-45 Year Olds

Apply resourcefulness at organizational scales by identifying inefficiencies and creative solutions. Develop systems that maximize return on all resources—financial, human, and material. Create cultures of resourcefulness among those you lead.

4. Negotiation Skills (Art of the Deal)

Historical Context

Chanakya devoted significant attention to negotiation strategies for different contexts, recognizing that resource exchanges significantly impact prosperity. The text outlines approaches for various negotiation scenarios, from diplomatic treaties to commercial transactions. European empires developed sophisticated negotiation approaches that secured favorable trade terms and resource access.

Contemporary Relevance

Negotiation remains a fundamental skill for resource accumulation, affecting everything from salary to business deals to strategic partnerships. Research shows that negotiation outcomes can create substantial resource differentials over time, with skilled negotiators securing significantly better terms across multiple domains.

Key Principles

- Preparation Thoroughness: Research extensively before entering negotiations

- Interest Focus: Identify underlying interests rather than fixating on positions

- Value Creation: Seek opportunities to expand resources rather than merely dividing them

- BATNA Development: Strengthen your Best Alternative To Negotiated Agreement

- Relationship Maintenance: Preserve relationships while advocating for your interests

Practical Application

To develop negotiation skills:

- Create a preparation template for different negotiation contexts

- Practice identifying interests behind stated positions

- Develop a repertoire of value-creating proposals

- Strengthen your alternatives before entering important negotiations

- Role-play negotiations with feedback from experienced negotiators

- Analyze past negotiations to identify patterns and improvement opportunities

For 17-25 Year Olds

Focus on developing fundamental negotiation skills through practice in low-stakes contexts. Prepare thoroughly for early career negotiations like job offers and compensation discussions. Study negotiation frameworks and practice applying them in various situations.

For 30-45 Year Olds

Develop more sophisticated negotiation approaches for complex, high-value situations. Focus on creating and claiming value in multi-party, multi-issue contexts. Apply negotiation skills to strategic partnerships and organizational resource allocation.

5. Value Creation (Engine of Prosperity)

Historical Context

Chanakya emphasized productive enterprises that generated new wealth rather than merely redistributing existing resources. The text outlines various value-creating activities from agriculture to manufacturing. European empires developed systems for transforming raw materials into higher-value goods, creating prosperity through value addition.

Contemporary Relevance

Sustainable resource accumulation ultimately depends on value creation—developing products, services, or systems that others value enough to exchange resources for. In modern economies, the ability to identify and address unmet needs through value creation is a primary path to significant resource accumulation.

Key Principles

- Need Identification: Recognize unmet needs or improvement opportunities

- Solution Development: Create offerings that address identified needs

- Value Communication: Effectively articulate the benefits of your solutions

- Scalability: Design value creation systems that can expand efficiently

- Continuous Innovation: Regularly improve and evolve your value offerings

Practical Application

To develop value creation skills:

- Regularly observe and document unmet needs or inefficiencies

- Practice ideating multiple solutions for identified needs

- Develop prototypes or minimum viable versions of your solutions

- Gather feedback and iterate based on user experience

- Study successful value creation models in various domains

- Create systems for capturing value from your solutions

For 17-25 Year Olds

Experiment with small-scale value creation projects to develop your capabilities. Look for opportunities to create value within existing organizations or educational contexts. Develop the habit of identifying problems and creating solutions.

For 30-45 Year Olds

Leverage your experience and resources to create value at larger scales. Consider entrepreneurial ventures, intrapreneurial initiatives, or investment in others' value creation. Develop systems that allow your value creation to scale beyond your personal efforts.

6. Long-Term Perspective (Vision of Generations)

Historical Context

Indian cultural traditions emphasize thinking across generations rather than just immediate gains. Chanakya advised rulers to consider the long-term consequences of resource decisions rather than focusing solely on immediate advantages. European empires that maintained multigenerational perspectives typically created more sustainable prosperity than those focused on short-term extraction.

Contemporary Relevance

Research consistently shows that longer time horizons correlate with greater wealth accumulation and resource sustainability. The ability to delay gratification and make decisions with extended time frames creates compound advantages that short-term thinking cannot match.

Key Principles

- Delayed Gratification: Willingness to forgo immediate benefits for greater future returns

- Compounding Awareness: Understanding how small advantages multiply over time

- Sustainability Focus: Ensuring resource systems remain viable long-term

- Legacy Orientation: Considering impact beyond personal timeframes

- Intergenerational Thinking: Planning for resource transfer across generations

Practical Application

To develop a long-term perspective:

- Create a 10/20/30-year vision for your resources and impact

- Practice making decisions using extended time horizons

- Develop metrics that track long-term progress, not just short-term gains

- Study historical examples of long-term thinking and its results

- Create systems that maintain focus on distant objectives

- Regularly review and adjust long-term plans while maintaining core direction

For 17-25 Year Olds

Take advantage of your long time horizon by making decisions that prioritize learning, skill development, and foundation-building over immediate returns. Develop the habit of considering second and third-order consequences of resource decisions.

For 30-45 Year Olds

Balance immediate responsibilities with continued long-term perspective. Begin developing legacy plans for resource transfer and impact continuation. Create systems and cultures that maintain long-term thinking despite short-term pressures.

Integration: The Resource Accumulation Pyramid

These six elements form a hierarchical pyramid of resource mastery:

- Financial literacy provides the foundation for informed resource decisions

- Strategic saving and investing creates systematic resource growth

- Resourcefulness maximizes the utility of available assets

- Negotiation skills secure favorable terms in resource exchanges

- Value creation generates new resources through addressing needs

- Long-term perspective ensures sustainable resource development

By developing each element and understanding their interconnections, you create a comprehensive approach to resource accumulation that supports your ambitions and extends your influence.

Implementation Summary

- Complete the Financial Intelligence Assessment to establish your baseline

- Create or optimize your systematic saving and investing system

- Conduct a resource inventory to identify underutilized assets

- Develop a negotiation preparation template for important exchanges

- Identify at least one value creation opportunity in your environment

- Create a 10/20/30-year vision for your resources and impact

For detailed implementation guidance, visit the Implementation Worksheets section.